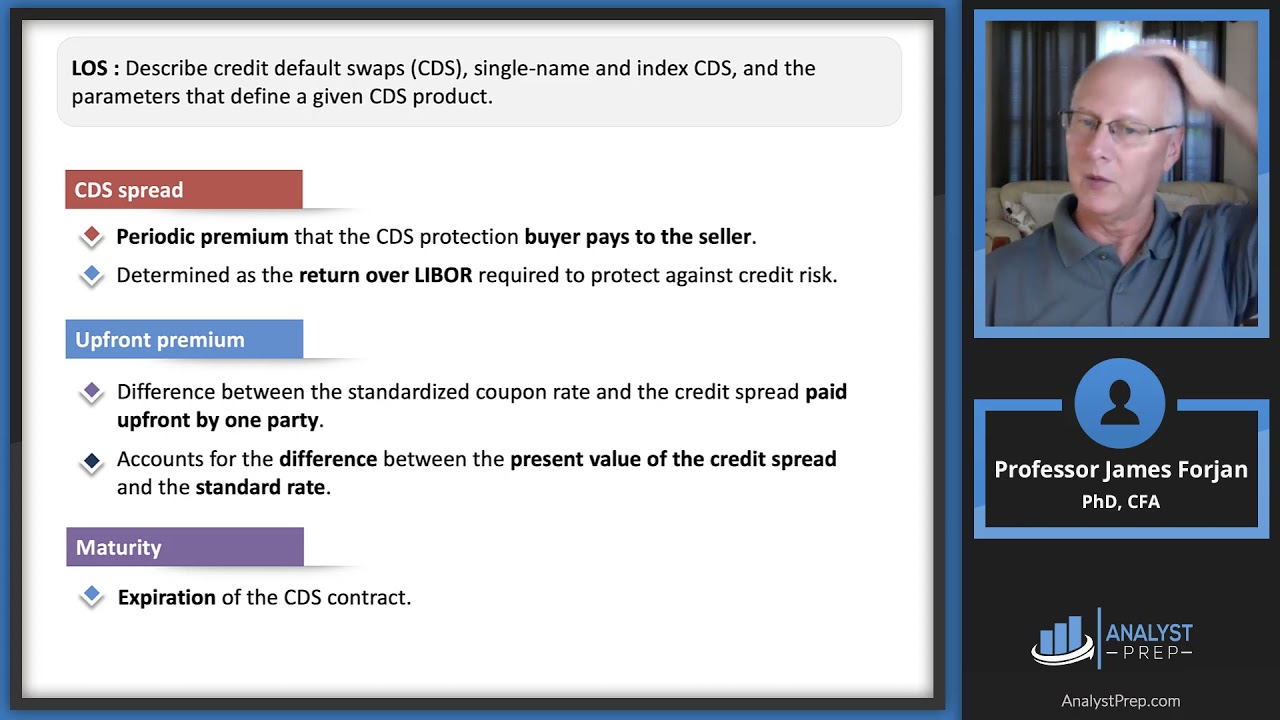

Comparison of the CDS prices derived from formula and that from Monte... | Download Scientific Diagram

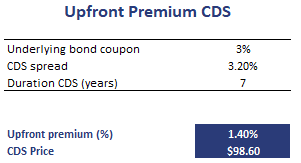

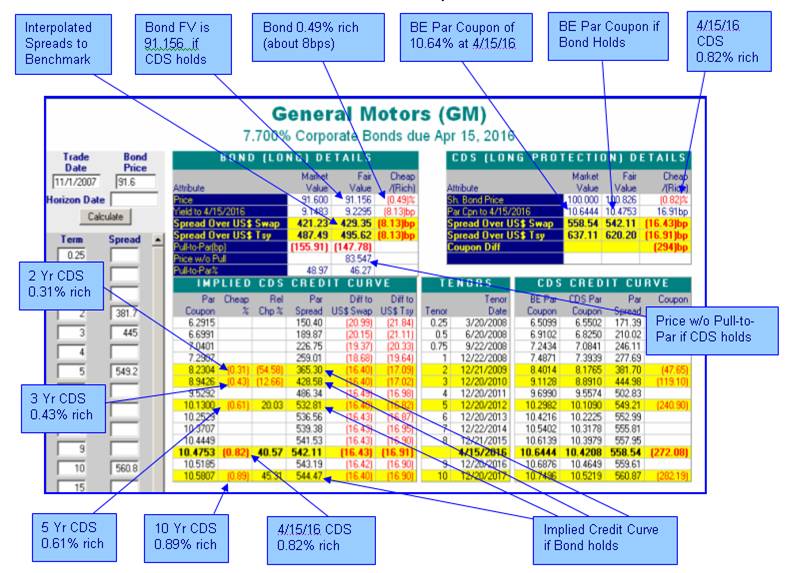

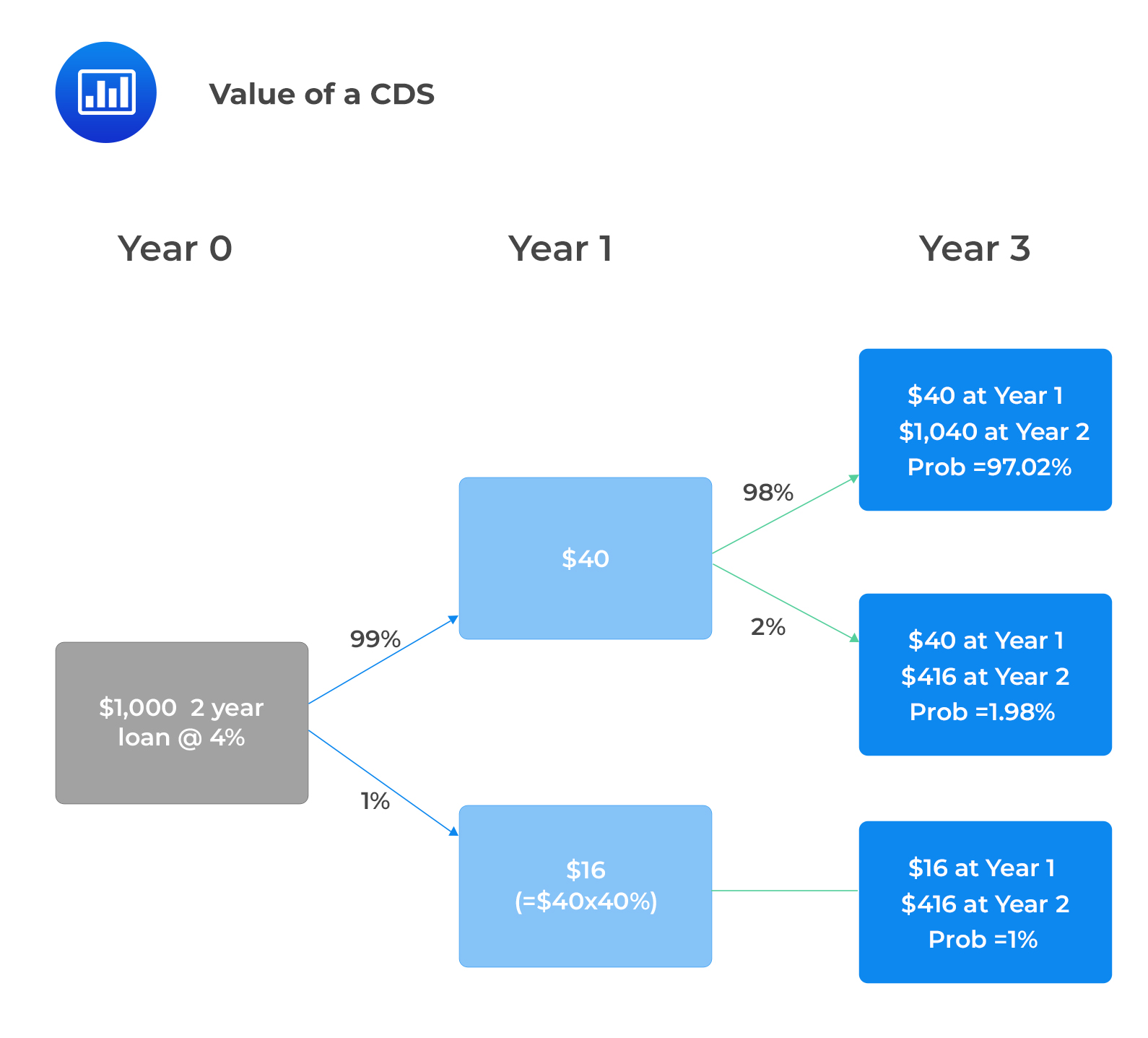

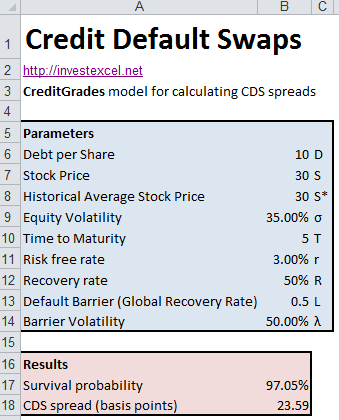

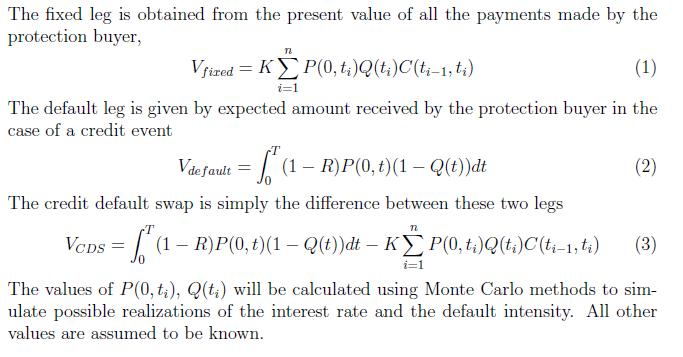

Ming Zhao on X: "4/ How are CDS swaps priced? TLDR: Price (aka "premium") of a CDS is determined by setting buyer expected value (EV) equal to seller EV and solving the

:max_bytes(150000):strip_icc()/Term-Definitions_Credit-default-swap-63dfdd6f916e4dfa8fb524fc387273c6.jpg)